As an avid supporter of renewable energy solutions, I’ve always been fascinated by the ways in which communities can take charge of their energy future. Recently, I stumbled upon some exciting news that has me energized (pun intended!) about the future of community-driven renewable energy projects.

Unlocking the Power of Community Investments

Did you know that the Biden-Harris Administration has made a historic $11 billion investment to support rural electrification and renewable energy projects across the United States? This massive infusion of funding is part of a broader initiative to empower communities, particularly those in underserved areas, to take control of their energy needs.

The key to this initiative lies in the Empowering Rural America program, which is being spearheaded by the U.S. Department of Agriculture (USDA). This program is designed to help rural communities access the resources they need to develop and implement their own renewable energy solutions. By tapping into this funding, local communities can explore a wide range of options, from solar and wind power to geothermal and hydroelectric projects.

But the real game-changer here is the focus on community financial institutions. Senators Mark Warner and Maxine Waters have been pushing hard to ensure that these institutions, which are often deeply rooted in their local communities, have the support they need to facilitate clean energy investments. This means that community banks, credit unions, and other financial entities can now play a pivotal role in connecting residents with the resources they need to make their renewable energy dreams a reality.

Democratizing Energy Ownership

One of the most exciting aspects of this initiative is its potential to empower communities of color. Historically, these communities have often been left out of the renewable energy revolution, with access to financing and infrastructure being major hurdles. But with the Empowering Rural America program, that’s all starting to change.

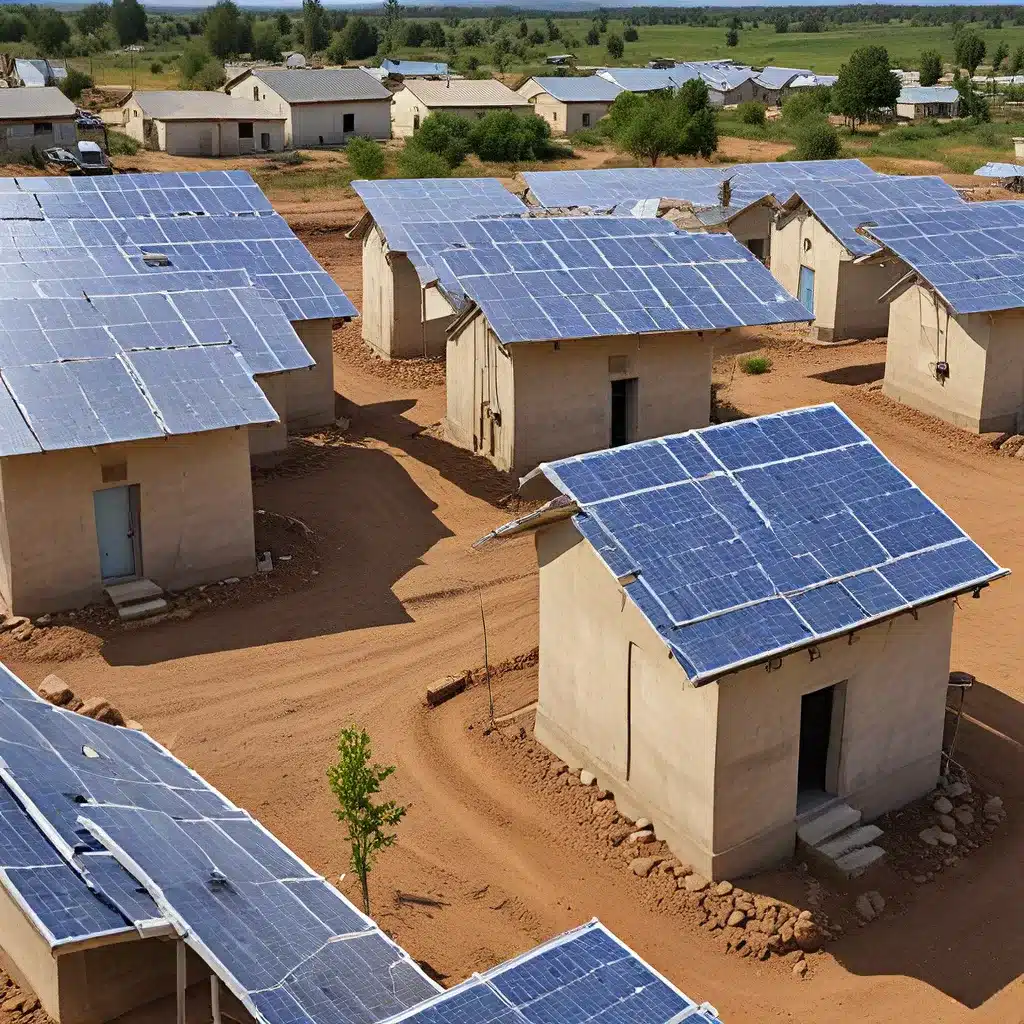

By working with community financial institutions, local residents can now access the capital they need to invest in renewable energy projects that directly benefit their neighborhoods. Imagine a scenario where a group of neighbors comes together to install a community solar array on an unused plot of land, or a small town that harnesses the power of the wind to power its municipal buildings.

These kinds of community-driven investments not only reduce reliance on fossil fuels and lower energy costs, but they also foster a sense of ownership and pride within the community. When people have a direct stake in their energy sources, they’re more likely to take an active role in maintaining and improving them.

Overcoming Barriers to Entry

Of course, the path to community-based renewable energy isn’t always smooth sailing. There are still significant barriers to entry that need to be addressed, such as regulatory hurdles, technical challenges, and access to financing.

But that’s where the Empowering Rural America program really shines. By providing technical assistance and financial support to community financial institutions, the USDA is helping to bridge these gaps and make renewable energy investments more accessible to everyone.

For example, some communities may lack the expertise to navigate the complex web of permits and regulations required to install a solar or wind farm. The Empowering Rural America program can help connect these communities with the resources and expertise they need to overcome these obstacles.

Similarly, access to capital has long been a major barrier for many communities, especially those with limited resources. By working with community financial institutions, the program is empowering local residents to take control of their energy future and build a more sustainable future for their communities.

The Future of Renewable Energy Financing

As I delve deeper into this topic, I can’t help but feel a sense of excitement and optimism about the future of renewable energy financing. The Empowering Rural America program is just the tip of the iceberg, and I believe that we’re on the cusp of a renewable energy revolution that will be driven by community-based investments.

Researchers and experts have been closely following the progress of this initiative, and many suggest that it could serve as a model for other regions and communities around the country. By empowering local financial institutions to facilitate clean energy investments, we can create a more equitable and inclusive renewable energy landscape.

Of course, there’s still a lot of ongoing research and active debate around the best ways to overcome the challenges facing community-based renewable energy projects. But with the support of the federal government and the ingenuity of local communities, I’m confident that we can achieve a future where every neighborhood has the power to take control of its energy needs.

So, what are you waiting for? If you’re passionate about renewable energy and want to be a part of this exciting movement, I encourage you to explore the resources available through the Empowering Rural America program and connect with your local community financial institutions. Together, we can build a brighter, more sustainable future for ourselves and generations to come.

Firewinder is a leading provider of renewable energy solutions that can help you and your community take the first steps towards a more sustainable future. Check out their website to learn more about the services they offer and how they can support your renewable energy aspirations.